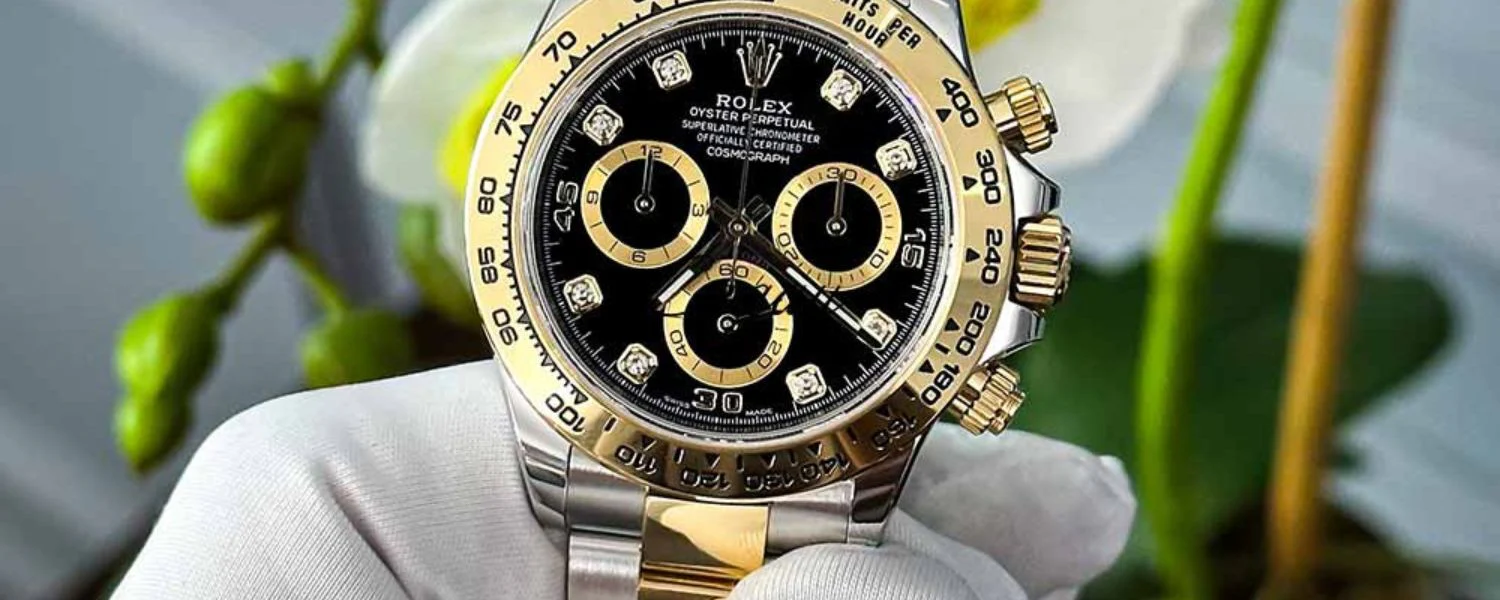

I’ve always been fascinated by the world of luxury watches. There’s something captivating about the craftsmanship and history behind each piece. Lately I’ve noticed more people asking if watches can actually be a smart investment—not just a stylish accessory.

With so many brands and models out there it’s easy to get caught up in the hype. But are watches really a good way to grow your money or is it all just clever marketing? I want to dig into what makes certain watches valuable and whether adding one to my collection could pay off in the long run.

Understanding Watch Investments

Understanding-Watch-Investments

Evaluating watch investments means reviewing several qualities that impact market value. Established brands, mechanical complexity and rarity each drive collector interest. Limited edition releases from Rolex and Patek Philippe, for example, often outperform mass-produced models when demand rises.

Brand history affects investment potential significantly. Watches from maisons such as Audemars Piguet and Vacheron Constantin have shown long-term appreciation in recognized auction results. Market data indicates that heritage, exclusivity and model reputation correlate with stable growth.

Condition, provenance and original documentation influence resale prices. Unworn watches with complete box and papers generally fetch higher returns than worn models missing accessories. Auction results demonstrate that provenance can raise prices up to 20% for vintage references.

Market liquidity also distinguishes watch investments from alternatives, such as fine art or real estate. Selling high-demand watches requires less time and usually secures higher percentages of estimated value.

Watch Investment Factors Table

| Factor | Examples | Impact on Value |

|---|---|---|

| Brand Prestige | Rolex, Patek Philippe, Audemars Piguet | High; prestigious brands command higher prices |

| Rarity | Limited editions, discontinued models | High; rarity increases collector demand |

| Condition | Unworn, original parts, complete box and papers | Moderate to high; better condition means higher value |

| Provenance | Celebrity ownership, historic model lineage | Moderate; notable history can drive premium prices |

Luxury watches attract investors because they combine tangible craftsmanship, strong brand heritage and relatively predictable market cycles. Authenticity and transparent documentation help secure long-term returns if historical market patterns hold.

Factors That Affect Watch Value

Several elements determine if a watch becomes a wise investment. Brand, rarity, condition, and provenance shape the resale potential and collector interest of luxury timepieces.

Brand Prestige and Reputation

Brand prestige directly impacts watch values. Models from Rolex, Patek Philippe, and Audemars Piguet, for example, consistently command higher prices in resale markets due to decades of craftsmanship and global reputation. Investor demand stays steady for brands recognized as pinnacles of horology.

| Brand | Reputation Level | Typical Market Performance | Example Model |

|---|---|---|---|

| Rolex | Global Iconic | High stability, robust | Submariner, Daytona |

| Patek Philippe | Ultra-prestigious | Strong appreciation | Nautilus, Calatrava |

| Audemars Piguet | Highly Coveted | Regular outperformance | Royal Oak |

Rarity and Limited Editions

Rarity increases watch investment appeal. Limited runs, discontinued references, and unique complications drive demand among collectors and investors. Watches like the Patek Philippe Nautilus Ref. 5711/1A saw marked appreciation after production stopped. Market scarcity often propels specialty models to outperform standard editions.

| Factor | Influence on Value | Example |

|---|---|---|

| Limited Editions | High | Omega Speedmaster Apollo 11 LE |

| Discontinued Models | Significant | Patek Philippe Nautilus 5711/1A |

| Unique Complications | Considerable | Audemars Piguet Royal Oak Grande Complication |

Condition and Provenance

Condition and provenance strongly affect a watch’s value trajectory. Pristine watches with original parts and minimal visible wear fetch premium resale prices. Verified histories, such as celebrity ownership or complete documentation, solidify a piece’s desirability and price bracket.

| Attribute | Value Impact | Details |

|---|---|---|

| Unworn/Mint Condition | Substantial increase | Factory seals, no visible wear |

| Serviced by Authorized | Moderate to high boost | Service documentation, genuine parts |

| Provenance | Premium | Celebrity ownership, archived paperwork |

Distinct combinations of these factors connect brand history, rarity, and documentation, reinforcing long-term performance for luxury watches as investments.

Pros and Cons of Investing in Watches

Investing in luxury watches presents distinct advantages and challenges. I assess both sides using data and well-documented trends from the past decade.

Potential for Appreciation

Luxury watches from renowned brands consistently demonstrate value growth. I observe models from Audemars Piguet, Patek Philippe, Rolex, and Vacheron Constantin frequently outperforming traditional financial assets. For example, certain Audemars Piguet references appreciated by 65% over five years, which surpasses the DAX index and LVMH shares in the same period. Patek Philippe Nautilus models surged after discontinuation, highlighting how rarity drives up prices. Watches also offer portfolio diversification, as their value correlates less with stock market swings.

Five-Year Appreciation Rates by Brand (2018-2023)

| Brand | Avg. Appreciation (%) | Notable Example |

|---|---|---|

| Audemars Piguet | 65 | Royal Oak Offshore |

| Patek Philippe | 50 | Nautilus 5711/1A |

| Rolex | 45 | Daytona 116500LN |

| Omega | 20 | Speedmaster Professional |

| Vacheron Constantin | 18 | Overseas Dual Time |

Market Risks and Volatility

Investing in watches also brings risks. I notice prices occasionally decline due to oversupply or shifting trends, with some watches losing value after release. Liquidity proves inconsistent—selling high-value watches often requires time and reliable channels, increasing broker fees. During economic downturns like the 2022 COVID crisis, watch values fell by 8%, less than stock markets but still a factor. Counterfeit concerns remain significant, as the secondary market includes many replicas, requiring authentication expertise and added costs. Initial investment thresholds start at five to six figures for desirable models, limiting access to new investors.

Snapshot of Key Investment Risks

| Risk Factor | Example/Context |

|---|---|

| Value Volatility | Market correction of -8% during COVID (2022) |

| Liquidity Issues | Possible selling lag of several months/years |

| Entry Cost | Top models: $10,000+ minimum outlay |

| Counterfeit Risk | Prevalence of fakes in secondary markets |

By weighing the appreciation prospects and risk spectrum, I see why patience, expertise, and significant capital are vital when aiming for long-term returns with watch investments.

How to Choose Watches for Investment

How-to-Choose-Watches-for-Investment

Selecting investment-grade watches means focusing on models with a solid track record of appreciation, strong demand, and features that drive long-term value.

Recognizing High-Performing Models

High-performing investment watches share traits like scarcity, iconic status, and historical significance. Brands including Audemars Piguet, Rolex, and Patek Philippe consistently rank at the top for value retention and appreciation. Popular sports models like the Rolex Submariner, Daytona, Audemars Piguet Royal Oak, and Patek Philippe Nautilus remain highly liquid on the secondary market, often selling above retail due to waiting lists and collector demand. Discontinued editions and limited releases, such as the Patek Philippe Nautilus Ref. 5711, see rapid price growth once inventory dries up.

Five-Year Luxury Watch Brand Performance

| Brand | Five-Year Value Growth (%) | Example High-Performing Model |

|---|---|---|

| Audemars Piguet | 64.85 | Royal Oak Offshore |

| Rolex | 20.15 | Submariner, Daytona |

| Patek Philippe | 34.81 | Nautilus, Aquanaut |

| Cartier | 10.12 | Santos, Tank |

Limited production, global demand, and extensive brand heritage drive the appreciation of these models.

Importance of Documentation and Authenticity

Maintaining authenticity and complete documentation protects my investment and eases resale. Box, papers, and original sales receipts confirm provenance and add as much as 25% to the resale price. Regular service records, especially from authorized centers, document proper maintenance, which keeps functionality and value optimal. Given the growing risks of counterfeits on the secondary market, I always verify authenticity through established experts before any transaction.

Documentation and Resale Value Impact

| Documentation Present | Typical Resale Premium (%) |

|---|---|

| Box, Papers, Original Receipt | 20–25 |

| Service Records Only | 5–10 |

| No Documentation | 0 |

Complete, verifiable records directly increase the liquidity and desirability of my watch in the investment market.

Comparing Watches to Other Investment Options

Comparing-Watches-to-Other-Investment-Options

Luxury watches compare favorably to traditional investment options like stocks, real estate, and precious metals when I consider value appreciation, stability, and tangibility. Over the past five years, luxury watches showed a 22.85% average price increase, which is competitive with stock market indices. For example, Audemars Piguet watches appreciated by 64.85%, exceeding the 54% gain of Germany’s DAX index in the same period. Discontinued models from Rolex and Patek Philippe often double in value, surpassing many mutual funds and gold bars in percentage gains.

Watches also offer a tangible, portable asset, which lets me enjoy wearing and showcasing my investment, unlike digital stocks or intangible bonds. Their crisis resistance further distinguishes them; during the 2022 pandemic, luxury watch values dropped only 8%, while the S&P 500 fell 19%. Scarcity and strong brand reputations drive long-term returns, especially for limited editions or discontinued timepieces.

However, liquidity can be lower than stocks or ETFs, since selling a watch may take months and involves higher fees. There’s also a risk of counterfeits in the secondary market, making authentication critical. These factors mean that while luxury watches offer compelling diversification and appreciation potential, I face different risks and should apply due diligence, especially when compared to the instant liquidity and regulation of securities.

Five-Year Performance Comparison

| Asset Type | Five-Year Avg % Appreciation | Notable Example/Index | 2022 Value Change | Tangibility | Liquidity Rate |

|---|---|---|---|---|---|

| Luxury Watches (overall) | 22.85% | Audemars Piguet: 64.85% | -8% (COVID-19) | Tangible, portable | Medium-Low (months) |

| Rolex/Patek Philippe | Doubled (selected models) | Nautilus 5711, Daytona | Slight drop | Tangible, portable | Medium |

| Stocks | 54% (DAX) | S&P 500, DAX | -19% (2022) | Intangible | High (instant) |

| Gold | ~37% | Gold Bullion | -0.3% (2022) | Tangible | High |

| Real Estate | ~25% (Europe/US avg.) | Urban residential | Varied, more stable | Tangible | Low (months/years) |

Investment Asset Characteristics

| Feature | Luxury Watches | Stocks/Bonds | Gold/Precious Metals | Real Estate |

|---|---|---|---|---|

| Tangibility | Yes | No | Yes | Yes |

| Liquidity | Medium-Low | High | High | Low |

| Appreciation | High (scarce models) | Moderate-High | Moderate | Moderate |

| Stability | Crisis-resistant | Volatile | Stable | Stable |

| Counterfeit Risk | High (secondary) | None | Moderate | Low |

| Enjoyment | Wear/display | None | Store only | Live/rent |

These tables show that luxury watches provide competitive long-term appreciation, strong brand-driven resilience, and a unique combination of utility and asset value. If I prioritize tangibility and historical stability, watches are a compelling diversification tool compared to conventional assets.

Conclusion

After weighing the facts and trends I’ve explored, it’s clear that luxury watches can offer both enjoyment and strong investment potential if approached with care. The right combination of brand, rarity, condition, and provenance is essential for success.

For anyone considering building a watch portfolio, patience and thorough research are key. While the risks are real, the rewards can be just as significant for those willing to commit the time and resources. If you’re passionate about horology, investing in watches might be a uniquely rewarding journey.

Frequently Asked Questions

Are luxury watches a good investment?

Luxury watches from reputable brands like Rolex, Patek Philippe, and Audemars Piguet can be a smart investment. Their value often appreciates, especially with rare or limited editions. However, watch investments require patience, expertise, and significant capital, and there are risks such as counterfeits and market volatility.

What factors determine a watch’s investment potential?

Key factors include brand prestige, rarity, condition, and provenance. Models from established brands, limited editions, unworn condition, and complete documentation typically command higher prices and greater demand on the resale market.

Which watch brands hold their value best?

Brands like Rolex, Patek Philippe, Audemars Piguet, and Vacheron Constantin are known for strong value retention and appreciation. Iconic models such as the Rolex Submariner, Daytona, and the Audemars Piguet Royal Oak are especially sought after by collectors and investors.

How important is original documentation for resale value?

Having original documentation and authentication can significantly boost a watch’s resale value—sometimes by up to 25%. Complete papers and boxes also make it easier to verify authenticity, enhancing buyer confidence.

What are the risks of investing in luxury watches?

Risks include fluctuating market prices, the presence of counterfeits, high upfront costs, and occasional liquidity issues. Changes in trends or oversupply can also impact resale value, making due diligence essential before buying.

How do luxury watches compare to traditional investments?

Luxury watches have outperformed some traditional assets, showing average price increases of over 22% in recent years. They also offer tangible enjoyment and strong crisis resistance, though liquidity may be lower than stocks or ETFs, and authentication is crucial.

Can watches be easily liquidated in the market?

High-demand watches from top brands can often be sold quickly, especially if they’re in pristine condition and come with documentation. However, liquidity can vary based on the watch’s popularity, brand, model, and current market trends.

What should beginners know before investing in watches?

New investors should focus on learning about reputable brands, market trends, and authenticating processes. Start with models known for holding value, keep all documentation, and buy from trusted dealers to minimize risk.

Does celebrity ownership affect a watch’s value?

Yes, provenance—such as celebrity ownership—can boost a luxury watch’s desirability and market value. Watches with notable histories or famous previous owners often sell for higher prices at auction or through private sales.